Introduction

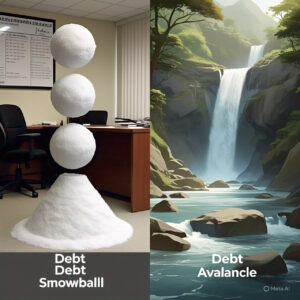

Being buried in debt is like carrying a heavy burden—it restricts your financial freedom and increases stress. But choosing the right strategy can help you become debt-free faster and smarter. Today, we’ll discuss two popular debt repayment strategies:

-

Debt Snowball Method

-

Debt Avalanche Method

In this guide, you’ll learn:

✔️ Which method is more effective for you

✔️ Pros and cons of each approach

✔️ Real-life examples to help you choose the right one

Studies show that 80% of people don’t know the right debt repayment strategy, leading to higher interest payments and wasted time. Let’s find out how to pick the best method for you!

1. Debt Snowball Method: Pay Off Smallest Debts First

How It Works?

With this method, you:

-

List debts from smallest to largest (not by interest rate)

-

Focus on paying off the smallest debt first

-

Once a debt is cleared, apply its payment to the next debt

Example:

| Debt Type | Balance | Minimum Payment |

|---|---|---|

| Credit Card 1 | ₹20,000 | ₹2,000 |

| Personal Loan | ₹50,000 | ₹5,000 |

| Car Loan | ₹3,00,000 | ₹10,000 |

Approach:

-

First, pay off Credit Card 1 (₹20,000)

-

Then the Personal Loan, and finally the Car Loan

Pros of Debt Snowball:

✅ Boosts Motivation – Quick wins keep you encouraged

✅ Easy to Follow – No complex calculations needed

✅ Reduces Number of Debts – Gradually eliminates multiple debts

Cons of Debt Snowball:

❌ May Cost More in Interest – Larger debts keep accumulating interest

❌ Can Take Longer – If big debts have high interest

Who Should Use It?

-

Those who need quick wins for motivation

-

People with many small debts

2. Debt Avalanche Method: Pay Off Highest-Interest Debts First

How It Works?

With this method, you:

-

List debts by interest rate (highest to lowest)

-

Focus on paying off the highest-interest debt first

-

Once a debt is cleared, apply its payment to the next debt

Example:

| Debt Type | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | ₹20,000 | 18% | ₹2,000 |

| Personal Loan | ₹50,000 | 12% | ₹5,000 |

| Car Loan | ₹3,00,000 | 8% | ₹10,000 |

Approach:

-

First, pay off Credit Card 1 (18% interest)

-

Then the Personal Loan (12%), and finally the Car Loan (8%)

Pros of Debt Avalanche:

✅ Saves More on Interest – Long-term cost-effective

✅ Faster Debt Freedom – Eliminates high-interest debt quickly

✅ Mathematically Efficient – Minimizes total repayment

Cons of Debt Avalanche:

❌ Requires Patience – Takes time to see progress

❌ Less Motivational – No quick wins

Who Should Use It?

-

Those who want to minimize interest costs

-

People with large high-interest debts

-

Individuals comfortable with number crunching

Debt Snowball vs Debt Avalanche: Which is Better for You?

| Factor | Debt Snowball | Debt Avalanche |

|---|---|---|

| Focus | Smallest debt first | Highest interest first |

| Motivation | Quick wins | Slow but steady |

| Interest Savings | Less | More |

| Ease of Use | Simple | Requires calculation |

Mathematical Example:

Assume you can pay an extra ₹10,000/month toward debt.

Debt Snowball:

-

Credit Card 1 paid in 4 months

-

Personal Loan paid in 10 months

-

Total time: 14 months, Interest paid: ~₹25,000

Debt Avalanche:

-

Credit Card 1 paid in 4 months

-

Personal Loan paid in 8 months

-

Total time: 12 months, Interest paid: ~₹20,000

Verdict:

-

If you need quick motivation → Debt Snowball

-

If you want maximum interest savings → Debt Avalanche

Bonus Tips: How to Pay Off Debt Faster

-

Increase Income: Freelancing, part-time jobs

-

Cut Expenses: Cancel unnecessary subscriptions

-

Refinance Debt: Convert high-interest loans to lower rates

-

Use Bonuses/Windfalls: Apply tax refunds or gifts toward debt

Final Words

Both Debt Snowball and Debt Avalanche are effective—the best choice depends on your financial behavior. The key is to pick a method and stick with it.

Which method will you use? Comment below!

SEO Optimization:

-

Focus Keywords: Debt repayment methods, debt snowball, debt avalanche, how to reduce debt, interest savings

-

Meta Description: “Debt Snowball vs Debt Avalanche—which is right for you? Learn the best strategies to pay off debt faster in this guide!”

-

Image Suggestions: Debt repayment infographic, interest rate comparison chart